- QUICKBOOKS PAYROLL SERVICE CREATED BY PAYROLL SERVICE HOW TO

- QUICKBOOKS PAYROLL SERVICE CREATED BY PAYROLL SERVICE SOFTWARE

QUICKBOOKS PAYROLL SERVICE CREATED BY PAYROLL SERVICE HOW TO

See also How to Zero Out Retained Earnings in quickbooks? Steps to Record Payroll Taxes in QuickBooks: After reading this article you should be able to record payroll taxes in QuickBooks. In this article, we discussed how to record payroll taxes in QuickBooks in-depth and in detail. The calculation of the payroll is strongly influenced by the legal system of the country. Payroll accounting typically includes wages, bonuses, salary, commissions, employees overtime, etc. Payroll Accounting is a type of process which includes the recording of payments of a company’s employees. QuickBooks provides integrated tools like monitoring financial reports, tracking expenses, bank records, dragging invoices, etc. QuickBooks help users to run their business more easily.

QUICKBOOKS PAYROLL SERVICE CREATED BY PAYROLL SERVICE SOFTWARE

It is full-fledged accounting software that is used for accounting purposes. QuickBooks is market-driving monetary Accounting programming.

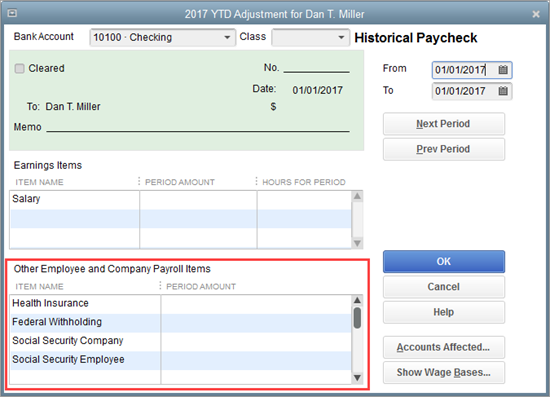

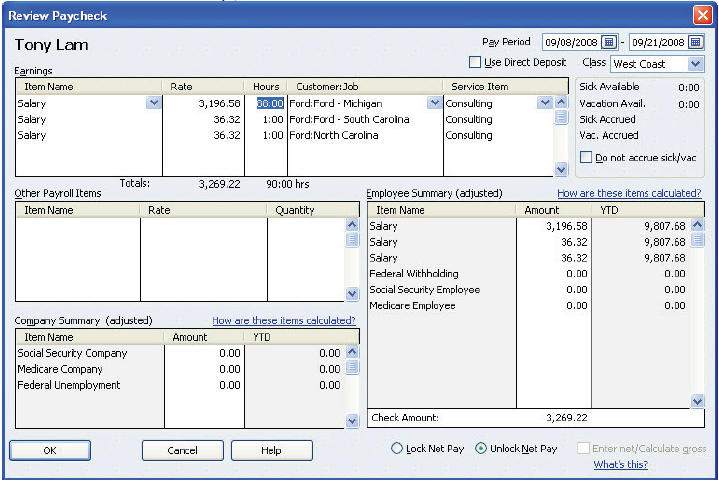

QuickBooks Payroll can be complicated and can be time-saving. QuickBooks Payroll provides users to fulfill their business requirements, it allows users to manage and control their company’s payroll. Payroll helps Human resources and employees to manage their services for small businesses. It includes calculating employee earnings and deducting federal and state payroll taxes. QuickBooks Payroll is part of QuickBooks which is used to manage an organisations processes like onboarding, compensation calculation, attendance tracking, and benefits administration.

0 kommentar(er)

0 kommentar(er)